- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

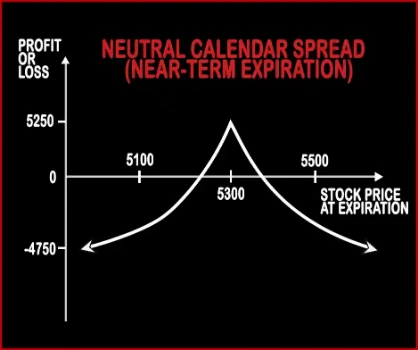

NEUTRAL CALENDAR SPREAD

Neutral Calendar Spread Option strategy

This strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option, hence reducing the cost of purchase, with the same strike price of the same underlying asset. This strategy is used when the trader wants to make money from the rapid time decay of the option.

Risk: Limited

Reward: Limited

Suppose that NIFTY is trading at 5300 levels, Mr. X is neutral about the market and expects it to remain sideways in the near future say 2 months or so. Hence, he will implement this Neutral Calendar Spread Strategy, he will sell 15300 NIFTY April (near-month) ATM Call Option for a premium of Rs.65 and buy 15300 NIFTY May (mid-month) ATM Call Option at a premium of Rs.160. The lot size of NIFTY is 50. Hence, his net investment will be Rs.4750. [(160-65)*50]

Case 1: At Near-Month (April) expiry if NIFTY closes at 5000, then Mr. X will get to keep the premium amount i.e. Rs.3250. (65*50). At Mid-Month (May) expiry if NIFTY closes at 4800, then Mr. X will make a loss of premium amount i.e. Rs.8000 (160*250). His net payoff will result in a loss of Rs.4750 (3250-8000)

Case 2: At Near-Month (April) expiry if NIFTY closes at 5100, then Mr. X will get to keep the premium amount i.e. Rs.3250. (65*50). At Mid-Month (May) expiry if NIFTY closes at 5300, then Mr. X will make a loss of premium amount i.e. Rs.8000 (160*250). His net payoff will result in a loss of Rs.4750 (3250-8000)

Case 3: At Near-Month (April) expiry if NIFTY closes at 5500, then Mr. X will incur a loss of Rs.6750 [(200-65)*50]. At Mid-Month (May) expiry if NIFTY closes at 5700, then Mr. X will make a profit of Rs.12000 [(400-160)*250]. His net payoff will result in a profit of Rs.5250 (12000-6750)

Comments for NEUTRAL CALENDAR SPREAD

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments